News 2025-07-01

Porton Has Been Selected as a Representative Company in Frost & Sullivan's "2025 China Pharmaceutical CDMO Industry Insight Blue Book"

Recently, Frost & Sullivan released the “2025 China Pharmaceutical CDMO Industry Insight Blue Book”, a comprehensive analysis of the evolution and strategic trajectory of China’s pharmaceutical Contract Development and Manufacturing Organization (CDMO) sector. Rooted in an in-depth examination of market dynamics, technological innovation, and global competitiveness, the report elucidates how China’s CDMO industry is reshaping the global pharmaceutical value chain through specialized services, operational agility, and cutting-edge capabilities. As an industry-leading CDMO enterprise, and owing to its 20 years of unwavering commitment to innovation and breakthroughs, Porton Pharma Solutions has been successfully featured as a representative Chinese company in the Blue Book as a typical case study. (To read the Blue Book, click here)

“2025 China Pharmaceutical CDMO Industry Insight Blue Book” highlights the following:

• The Core Position of the CDMO Sector: How CDMOs support pharmaceutical companies across the entire drug development and manufacturing value chain.

• Four Development Stages of China’s CDMO Industry: From Policy Liberalization to Global Competition, tracing the evolution and growth of China’s CDMO sector.

• Dual-Engine Phase of Scale Expansion and Domain Segmentation: The expansion and specialization trends within China’s CDMO industry.

• Sub-sectors of CDMO: Detailed insights into Small Molecule, Peptide, Antibody, ADC, and CGT CDMO segments.

• Multi-Point Growth Pattern: The diverse growth points and strategic developments of China’s CDMO industry.

• Introduction to Selected Chinese CDMOs: Showcasing leading CDMOs in China and their contributions to the industry, including BiBo Pharma, Healthnice, Porton Pharma, ChemExpress, OBiO Technology, Pharmaron, PharmaBlock, Yaohai Bio-Pharma, uBriGene, Intellective Bio, Chinese Peptide, and TOT Biopharm.

The CDMO Sector Holds a Core Position in the Pharmaceutical Industry

As a major part of the outsourcing pharmaceutical service industry, CDMOs support pharmaceutical companies across the entire chain, from drug discovery to market launch, and from process development to large-scale manufacturing. They rely on large-scale production capacity and high value-added R&D and manufacturing processes. As a result, CDMOs have become key partners and hold a core position in China’s pharmaceutical industry.

Demand Drives Expansion and Subdivision of CDMOs

The continued evolution of global demand for biopharmaceutical R&D and manufacturing is pushing China’s CDMO industry into a dual-engine phase of scale expansion and domain segmentation. On one hand, the increasing technical complexity of emerging areas such as CGT, ADCs, and nucleic acid drugs is driving strong demand for specialized CDMO services. On the other hand, traditional segments like small molecule drugs continue to expand production capacity due to process optimization and steady market demand.

At the same time, differentiated demands from pharmaceutical companies are accelerating the diversification of service models. Biopharma companies tend to divest non-core manufacturing functions to focus on innovative pipelines, thereby driving CDMOs toward high-end process development. Biotech firms, constrained by resources, increasingly rely on one-stop services that provide full-cycle support from target validation to IND filing, prompting the rise of full-chain CDMO platforms. In response, Chinese CDMOs are using technological deployment and service model innovation to build entry barriers in niche areas while using large-scale production capacity to capture global orders, thus establishing a dual-path development model of “high-end breakthroughs + foundational consolidation.”.

Four Development Stages: Policy, Technology, and Capital-Driven the Closed-Loop Growth of China’s CDMO Industry

China’s pharmaceutical CDMO industry has gone through four key stages: policy liberalization, technology transfer, capital-driven growth, and global competition. The sector has moved from the early phase of reliant on foreign technology and policy incentives to a more advanced stage defined by deep technical expertise, global production layout, and integrated ecosystems. On the policy side, the implementation of the MAH system, stricter GMP standards, and medical insurance reform have pushed pharmaceutical companies to separate their manufacturing functions, creating strong demand for CDMO services. On the technology side, advancements in continuous flow chemistry, enzymatic catalysis, and AI-based drug design have increased the added value of services. On the capital side, funding has fueled the rise of emerging fields.

The industry now follows a closed-loop development model: policy-driven demand-technology-driven service upgrades-capital-driven expansion-global ecosystem integration. This reflects a shift in China’s CDMO sector from rapid scale expansion to high-quality development.

A Multi-Front Development Trend of China’s CDMO Industry

Chinese CDMO enterprises are strategically advancing vertically integrated service capabilities across the pharmaceutical value chain through organic growth and strategic mergers, aligning with China’s push for high-quality industrial development. As sector competition intensifies, differentiation through niche specialization has become critical. To address global capacity imbalances and optimize biologics production economics, CDMOs are prioritizing operational efficiency upgrades and smart manufacturing adoption.

Leading players are simultaneously executing multi-pronged globalization strategies: establishing GMP-compliant facilities in key overseas markets to secure long-term international competitiveness, while deepening technological moats through specialized R&D investments in advanced modalities. This dual approach enables breakthroughs in traditional competitive frameworks through differentiated capabilities. Global capacity networks are being rapidly expanded in overseas production hubs and acquisitions of internationally certified manufacturers, forming interconnected supply chains aligned with global pharmaceutical collaboration systems. Simultaneously, innovative CRDMO models are integrating value chain resources to create end-to-end service ecosystems spanning drug discovery to commercial manufacturing.

Case studies including BiBo Pharma, Porton Pharma, Healthnice, ChemExpress, OBiO Technology, Pharmaron, PharmaBlock, Yaohai Bio-Pharma, uBriGene, Intellective Bio and Chinese Peptide exemplify the diversified growth trajectories shaping China’s CDMO landscape. These enterprises demonstrate how strategic focus on technological innovation, operational excellence, and global integration is redefining the sector’s competitive dynamics.

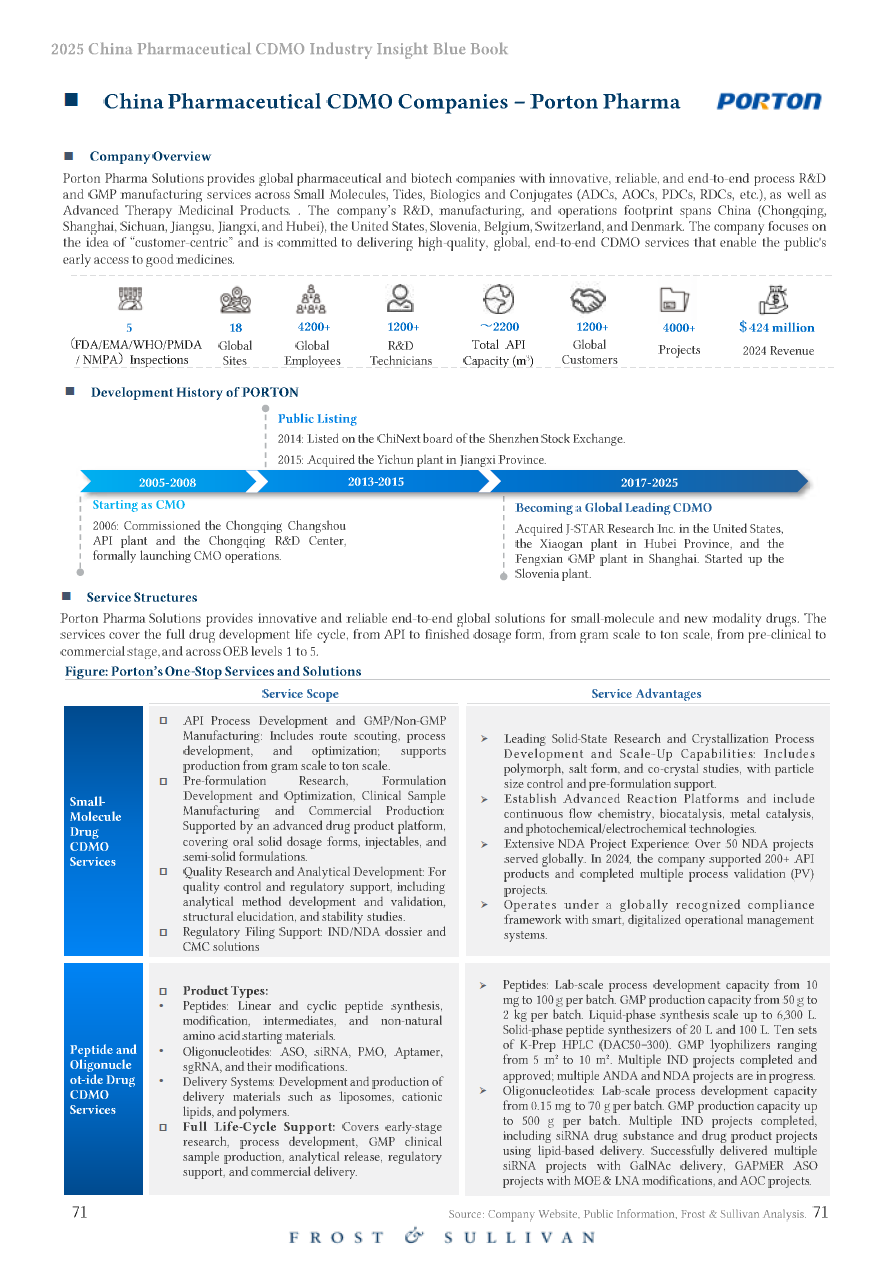

Porton's Feature in the Blue Book

Others

More

News 2025-10-10

Porton Newsletter - September 2025 Recap

Technical Enabling Services & Solutions Company Events ESG Marketing Activities Others

News 2025-09-28

Porton Shanghai Pudong Facility Obtained ISO 14001 and ISO 45001 Certification

Porton Pharma's Shanghai Pudong site successfully obtained ISO 14001 and ISO 45001 certifications, enhancing sustainable operations and CDMO capabilities for biotech clients.